The Pros and Cons of Using PayPal

PayPal is one of the most widely recognized online payment platforms, offering a convenient way to send and receive money. Over the years, PayPal has become a trusted tool for individuals, businesses, and freelancers around the world. However, while PayPal offers many benefits, it also has some limitations that users should consider. Below, we explore the pros and cons of using PayPal.

The Benefits of PayPal

- Wide Acceptance

PayPal is accepted by millions of merchants and service providers worldwide. Whether shopping online, paying for subscriptions, or making donations, PayPal provides a seamless payment option. Its global reach makes it particularly useful for international transactions. - Ease of Use

Setting up a PayPal account is quick and straightforward. The platform’s user-friendly interface allows people to link their bank accounts, debit cards, or credit cards effortlessly. Sending money is as simple as entering the recipient’s email address. - Security Features

PayPal prioritizes security by encrypting users’ financial information and offering buyer protection for eligible purchases. This ensures that sensitive data isn’t shared directly with sellers, reducing the risk of fraud. - International Payments

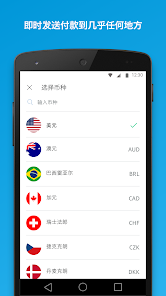

PayPal makes it easy to send money across borders. The platform supports multiple currencies, allowing users to pay or get paid without worrying about complex currency conversions. - Flexibility for Businesses

PayPal is an excellent tool for small businesses and freelancers. It allows merchants to accept payments through their websites or invoices and even offers integration with e-commerce platforms like Shopify. - Mobile App Convenience

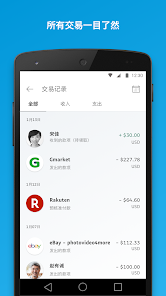

The PayPal app enables users to manage their transactions on the go. Features like sending money, paying bills, and checking account activity are all available within the app, providing a high level of convenience.

The Drawbacks of PayPal

- High Fees

PayPal’s fees can be a significant downside, especially for businesses. For example, receiving money from international transactions often incurs currency conversion fees and transaction charges, which can add up over time. - Account Freezing

One of the most frequent complaints about PayPal is its tendency to freeze accounts without warning. This can be frustrating for users who rely on PayPal for their income or business operations. Resolving such issues often requires lengthy verification processes. - Limited Customer Support

PayPal’s customer support has been criticized for being difficult to reach and sometimes unhelpful. For users facing urgent account issues, this can be a major drawback. - Exchange Rate Markups

When dealing with international payments, PayPal’s exchange rates often include a markup, which means users may lose money compared to standard market rates. This makes it less ideal for frequent cross-border transactions. - Lack of Anonymity

While PayPal is secure, it does require users to share personal and financial information when setting up an account. This may not appeal to those who prefer complete anonymity in their online transactions.

Conclusion

PayPal offers a wide range of benefits, from its ease of use and global acceptance to its security features and convenience for businesses. However, it’s not without flaws, such as high fees, account freezing issues, and limited customer support. Despite these drawbacks, PayPal remains a go-to solution for many individuals and businesses due to its reliability and versatility. Whether PayPal is the right choice depends on your specific needs and how you prioritize convenience, security, and cost.